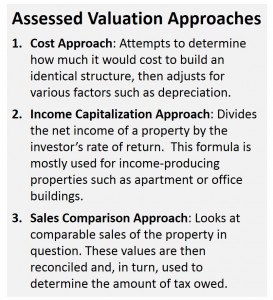

The recent property assessment battle for big-box retail stores may turn out to be short lived. In the December 2014 case of Meijer Stores v. Marion County Assessor (available here), the Indiana Board of Tax Review (“IBTR”) ruled that big-box stores like Meijer are allowed to use vacant or abandoned big-box retail stores when using the sales comparison approach to determine the value of their property for tax purposes. The IBTR had previously allowed a store like Meijer to be compared to different retailers, such as Wal-Mart, Lowes, or even Hobby Lobby, so long as the store being compared to was a big-box retailer currently in business. The rationale was simple: if you include vacant big-box retail stores in a list of comparable sales, the valuation is going to decline precipitously and may not reflect the true value.

Including vacant or abandoned big-box retail properties as comparables in this case would bring the value of the Meijer store in dispute from the $19.73 million as assessed by the Marion County Assessor down to only $7.17 million. Applying this difference to the 2002 to 2012 assessments would mean that Marion County could be liable for $2.4 million in the form of a tax refund to Meijer alone. Naturally, this decision has reverberated throughout the business community with other big-box retailers now considering appealing their tax assessments through the Property Tax Assessment Board of Appeals.

Including vacant or abandoned big-box retail properties as comparables in this case would bring the value of the Meijer store in dispute from the $19.73 million as assessed by the Marion County Assessor down to only $7.17 million. Applying this difference to the 2002 to 2012 assessments would mean that Marion County could be liable for $2.4 million in the form of a tax refund to Meijer alone. Naturally, this decision has reverberated throughout the business community with other big-box retailers now considering appealing their tax assessments through the Property Tax Assessment Board of Appeals.

While the Meijer ruling has retailers excited about potential tax refund windfalls and counties worried about refund-related budget shortfalls, this issue may quickly become moot due to a recent Indiana Senate Tax and Fiscal Policy Committee vote. On February 17, 2015, the Committee voted 12-0 to approve Senate Bill 436 sponsored by Senator Brandt Hershman (R – Buck Creek) which would essentially overrule the IBTR’s decision by requiring big-box stores and other chain stores to be valued solely by the cost approach to determine the market value-in-use of the property. This bill would affect properties assessed on or after the March 1, 2015, assessment date and would include cases currently going through administrative appeal or judicial proceedings, such as Meijer. (A text of the Committee Report can be found here.)

Considering the impact that these changing property tax assessments may have on the amount of taxes a business owes, it is important to ensure that the proper assessment methods are being used. We will continue to keep track of this important tax issue and provide updates as necessary. For more information about these changes to Indiana law or any area of real estate law, please contact Mike Schopmeyer (mschopmeyer@KDDK.com, (812) 423-3183); Mark Samila (msamila@KDDK.com, (812) 423-3183); Steve Theising (stheising@KDDK.com, (812) 423-3183); or Matt Malcolm (mmalcolm@KDDK.com, (812) 423-3183); or contact any member of the KDDK real estate law practice team.

About the Author

Mike Schopmeyer, a Co-Managing Partner at Kahn, Dees, Donovan & Kahn, LLP (KDDK), in Evansville, Indiana, has more than 30 years’ experience closing and resolving business, environmental, construction, real estate, and intellectual property deals and disputes. He has extensive experience in economic development law as well as government, school and municipal law. Honed from service as a private practitioner, government attorney, arbitrator, and civic leader, Mike’s financial acumen empowers clients to more swiftly reach durable solutions.