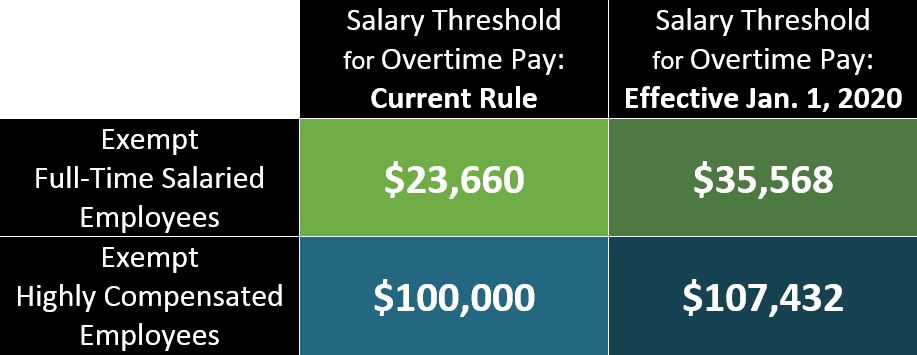

The U.S. Department of Labor (“DOL”) announced today its final overtime rule, increasing the minimum salary threshold for avoiding overtime eligibility to $35,568. The current annual salary threshold is $23,600. The final rule will become effective on January 1, 2020. It is estimated that the rule will extend overtime coverage eligibility to 1.2 million Americans.

The U.S. Department of Labor (“DOL”) announced today its final overtime rule, increasing the minimum salary threshold for avoiding overtime eligibility to $35,568. The current annual salary threshold is $23,600. The final rule will become effective on January 1, 2020. It is estimated that the rule will extend overtime coverage eligibility to 1.2 million Americans.

The Trump Administration’s increase is not as aggressive as the increase the Obama administration attempted to enact in 2016, which was blocked by a federal judge shortly before its effective date. That rule would have doubled the salary threshold to $47,500 and automatically updated it every three years to keep pace with cost-of-living increases. The rule announced today increases the standard salary level by approximately 50%, instead of doubling the threshold, and does not include automatic increases.

Further, the DOL’s new rule will:

- Raise the total annual compensation requirement for “highly compensated employees” from the currently enforced level of $100,000 per year to $107,432 per year;

- Allow employers to use non-discretionary bonuses and incentive payments (including commissions) paid at least annually to satisfy up to 10% of the standard salary level, in recognition of evolving pay practices; and

- Revise the special salary levels for workers in U.S. territories and the motion picture industry.

What Should Employers Do?

Businesses now have 99 days to comply with this new rule. Employers should review data for exempt workers earning close to the new eligibility cutoff and evaluate their 2020 pay structure for any exempt-classified employees earning less than the $35,568 threshold. Now is a good time to review workers’ job duties to ensure they satisfy the applicable exemption’s criteria. Employers also should weigh the cost of raising employee salaries above the new threshold against the cost of reclassifying employees as nonexempt and paying overtime.

These evaluations should be made in consultation with your human resources professional and/or legal counsel to ensure compliance with the new rules. For individualized guidance, or more information on this new DOL rule, please contact Mark McAnulty or Jordan Heck at (812) 423-3183, or contact any member of the KDDK Labor and Employment Law Practice Team.